According to www.fintechfutures.com, the following trends will play an important role in the nearest future.

1. CUSTOMER-CENTRIC APPLICATIONS

The proliferation of fintech solutions has brought customers to the forefront of every financial organisation’s thoughts. Where the financial industry once designed processes and applications to suit their own needs, today they must focus on delivering a high-quality customer experience if they want to remain competitive in a crowded marketplace.

Eliminating manual processes, cutting down on external software dependencies, and automating routine tasks will continue to be a major point of emphasis for fintech applications. Customers no longer have the patience to repeatedly fill out lengthy forms or go through the frustrating process of downloading, printing, signing, and scanning documents.

According to a recent IDG study on the enduring business impacts of the Covid-19 pandemic, about 40% of employees are expected to be working remotely on a semi-permanent basis as of January 2021. That means financial organisations will continue to need digital tools in place to provide secure access to files and facilitate collaboration. Physical documents must first be converted into a variety of digital formats with high levels of accuracy and then made available to remote users without compromising data integrity or creating confusion over version history.

Without a dedicated solution on hand for viewing, editing, and managing documents, users are forced to resort to a variety of ad hoc workarounds and third-party software solutions that can quickly compromise data security and increase the likelihood of errors. By integrating those features into their fintech applications, developers can help firms keep all of their documents and files safely within a secure infrastructure while still making them available through easy-to-use web-based API tools.

3. BIG DATA MANAGEMENT

Financial organisations continue collecting huge amounts of data in the course of their business. Some of these data are unstructured and must be processed using powerful analytics tools to identify important trends and potential risks that can help firms make better strategic decisions. But they also gather a great deal of structured data, typically from structured forms like loan applications, tax documents, and bank statements.

Managing all of this information more efficiently will be an important goal for 2021 because having good data insights is essential for identifying opportunities, optimising products and services, and automating essential services.

4. PANDEMIC PROOFING

Even if restrictions are lifted earlier than expected, the risk-averse financial industry will continue to think about how to avoid similar disruptions by implementing paperless processes and electronic data capture options.

Developers can help the financial industry better “pandemic proof” their processes by integrating better document viewing, file conversion, and data capture tools into their software solutions. Not only can they automate traditionally timeconsuming (and error-prone) manual data entry tasks, but they can also build in additional functionality to auto-generate data for new contracts and allow people to sign documents digitally to eliminate the need for face-to-face meetings.

5. BANKING PARTNERSHIPS

Banks and other traditional financial institutions are increasingly partnering with fintech startups to reach new customers and engage with existing clients over new channels.

The integration process will be easier if they have flexible software solutions in place that can navigate multiple file types, perform cleanup and conversion, and extract essential data quickly and accurately. Whether they’re building that functionality into entirely new applications or integrating features into existing legacy systems, fintech developers will play a key role in helping financial organisations accelerate their merger and partnership timetables so they can begin reaping the benefits more quickly.

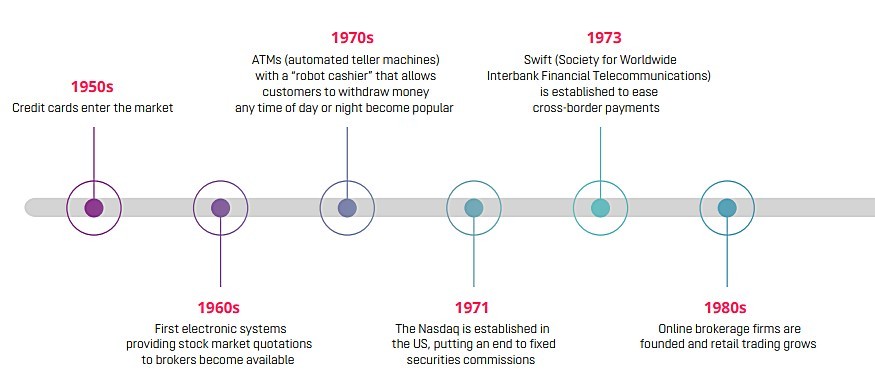

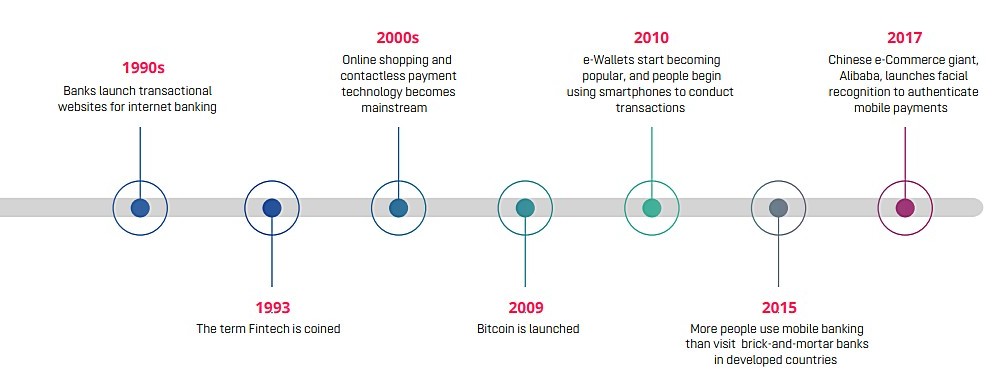

FINTECH FROM 1950 TO 2017

While the term “fintech” (finance and technology) became a buzzword with the turn of the millennium, the concept behind it is far from new. The financial services industry has long been the flagbearer of tech innovation.

Source: The Evolution of Fintech, The New York Times